About

Jo-Ann Weiner, EA, CFE

Jo-Ann Weiner, EA, CFE

founded J. L. Weiner & Associates, LLC in 2012.

She has over 35 years of experience with the IRS as a Revenue Agent auditing federal tax returns and working as a special enforcement agent on civil cases, criminal cases, and grand jury cases. She has served as an expert witness testifying in court for the government. Jo-Ann worked for the IRS as an outside contractor teaching Corporate Taxation to IRS Revenue Agents.

As a Director and Board Member for the New Jersey Society of Enrolled Agents, she teaches technical tax topics to South Jersey accountants. In that capacity she taught a course on Indirect Methods of Proving Income and another course on Self-Rentals. Recently Jo-Ann was invited to teach Form 1099-MISC by Lorman Seminars. She serves as a guest lecturer at Rowan College at Burlington County.

Jo-Ann received NAACP’s Frances Hooks Award in 2014 for “showing courage in promoting diversity and building bridges across cultures.” Jo-Ann volunteers her time to the American Heart Association.

Certifications:

Jo-Ann is an Enrolled Agent – the only designation licensed by the Federal Government of the United States,

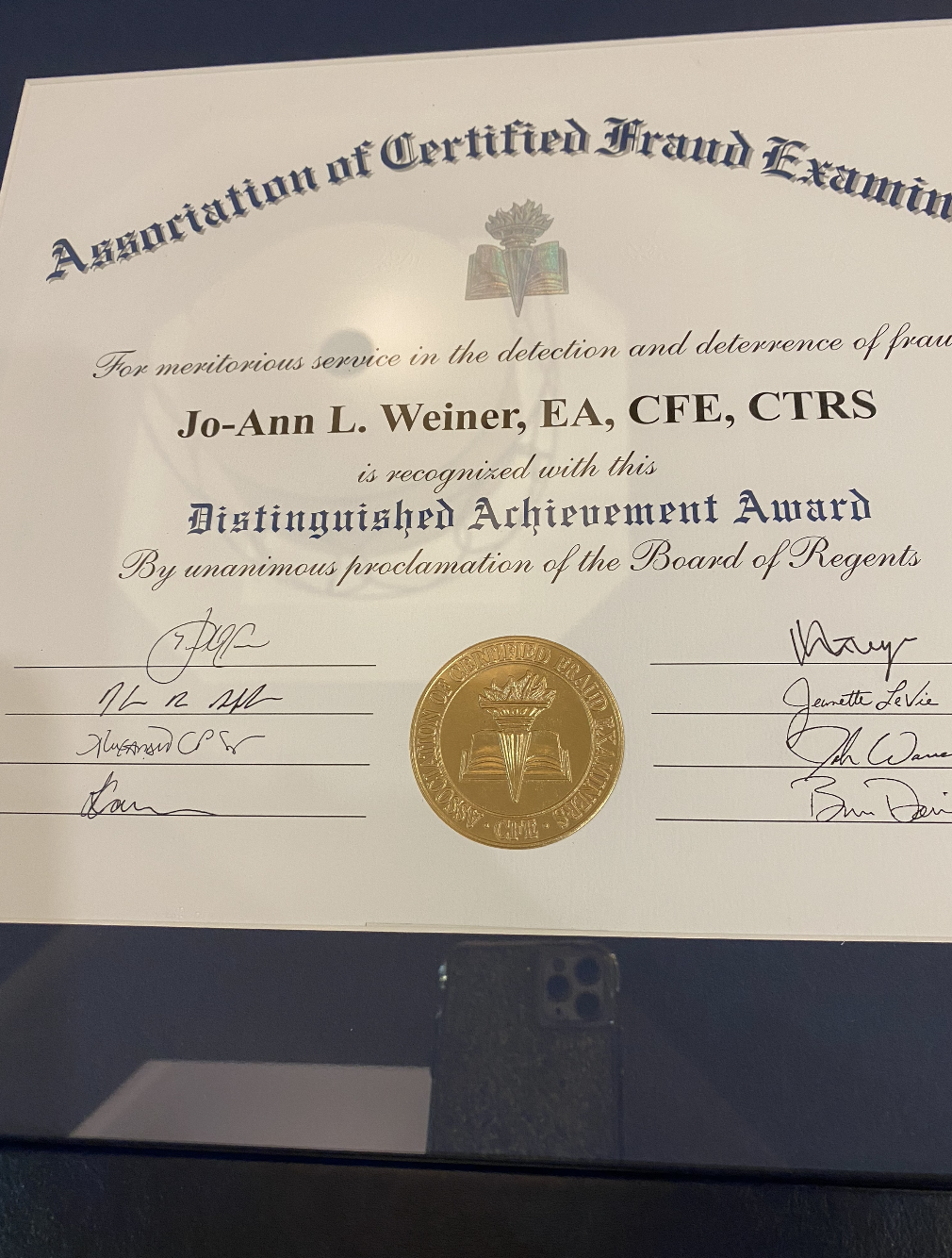

She is a Certified Fraud Examiner,

And Jo-Ann is a Certified Tax Resolution Specialist.

Memberships/Affiliations:

As one of “America’s Tax Experts” she is a member of the National and New Jersey Societies of Enrolled Agents.

Ms. Weiner is a member of the Association of Certified Fraud Examiners and a member of the National Association of Certified Valuators and Analysts.

In addition, she is a member of the Association of Tax Problem Solvers.

Ms. Weiner is a Director on the board of directors of the New Jersey Society of Enrolled Agents.

She is on the Taxes and Regulation/Advocacy Council for the National Association of Women Business Owners – NAWBO.

Jo-Ann is on the American Heart Association’s Executive Leadership Team and Red Dress Circle.

Recognition:

Jo-Ann received NAACP’s Francis Hooks Award in 2014 for showing courage in promoting diversity and building bridges across cultures.

She has begun a non-profit “Women Words and Wisdom” conducting an annual conference in recognition of women’s month.

Jo-Ann has been named as a “Woman to Watch” by SJ Biz magazine in 2019.

Jo-Ann’s practice consists of tax controversy resolution, determining assets in divorce cases, and criminal work. In her work as an expert witness, she has been “qualified as an expert witness” in relation to indirect methods of proving income.

Tax Controversy Resolution

Jo-Ann represents clients who are being audited by the federal government or the state. She is versed in the tax code and experienced in the scope and depth of audit requirements and standards. Jo-Ann’s experience stems from many years of training in taxation, conducting tax audits with the IRS, and her years of experience in private practice.

Divorce Cases

Jo-Ann has calculated assets and funds available for alimony determinations in contentious divorces. She is very experienced working with the tax code rules that relate to divorce, alimony, separate maintenance, child support, and dependencies. She is familiar with the rules.

Criminal Cases

Jo-Ann is Certified Fraud Examiner experienced in examination and determination of corporate fraud or embezzlements. Further she represents clients, as part of the legal team, regarding federal criminal tax charges. She has served as an expert witness in court.